When it comes to auto insurance, determining the amount of coverage you need to protect your vehicle can be a difficult task. Although third-party insurance is mandatory in most states, it will not cover theft or damages to your own car.

If you need extra protection against the other things that life may throw your way, you should consider purchasing comprehensive cover from one of the best auto insurance companies.

Here are five reasons why.

1. Cover Loss or Damage to Your Vehicle

If you rely on your vehicle to get to and from work and wouldn’t be able to afford a replacement if something should happen to it, comprehensive cover is something you should seriously consider.

The main difference between third-party insurance and comprehensive insurance is how it provides coverage for your car. While third-party policies protect you against the cost of damages to other drivers’ vehicles when you are involved in an at-fault accident, comprehensive coverage covers your own car as well.

Comprehensive coverage insures you against damage to your vehicle (even if you are at fault) and will protect you against the total loss of your vehicle if it gets stolen.

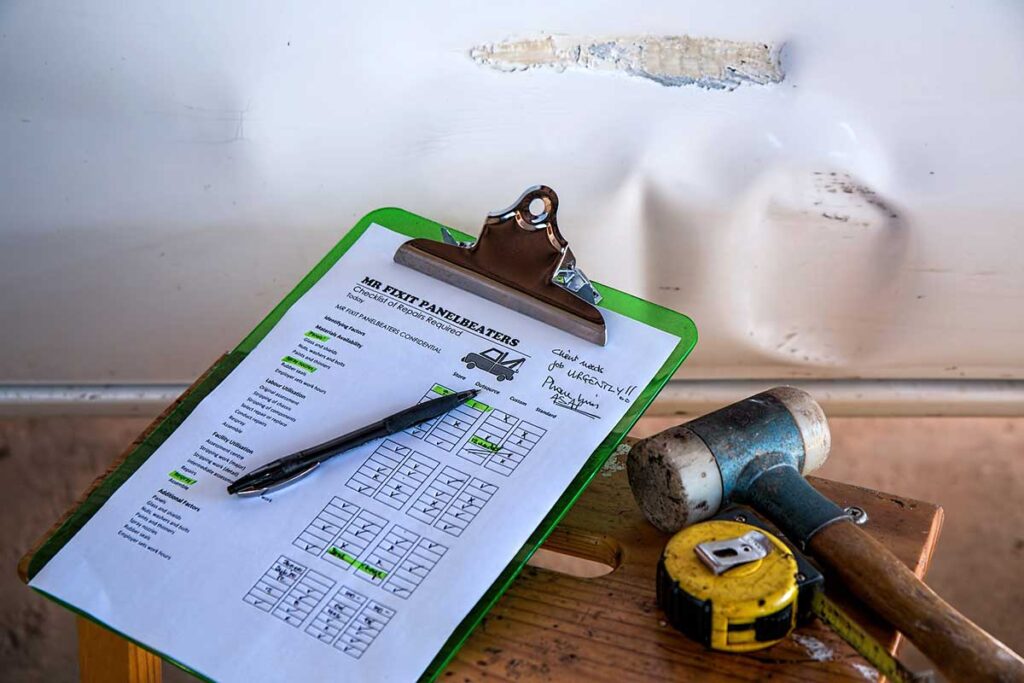

2. You Can Personalize Your Cover

If your car is damaged in an accident, how will you transport yourself to work while your car is in the shop for repairs? That’s where comprehensive insurance comes in.

You can take out a dump truck insurance policy for your business and adjust it to cover potential downtime and repairs, ensuring that your operations aren’t halted. This type of policy can also provide coverage for rental vehicles, allowing you to continue your work without interruption while your truck is being repaired.

Not only will comprehensive insurance cover the cost of repairing your vehicle, but you can also tailor your cover to include the cost of a car rental while your vehicle is being repaired.

Some insurance providers will cover the cost of emergency transport indefinitely if you are involved in an accident, and up to 14 days after your car is stolen. You can also choose to include the cost of emergency accommodation in your cover – which can be a lifesaver if you have an accident far away from home.

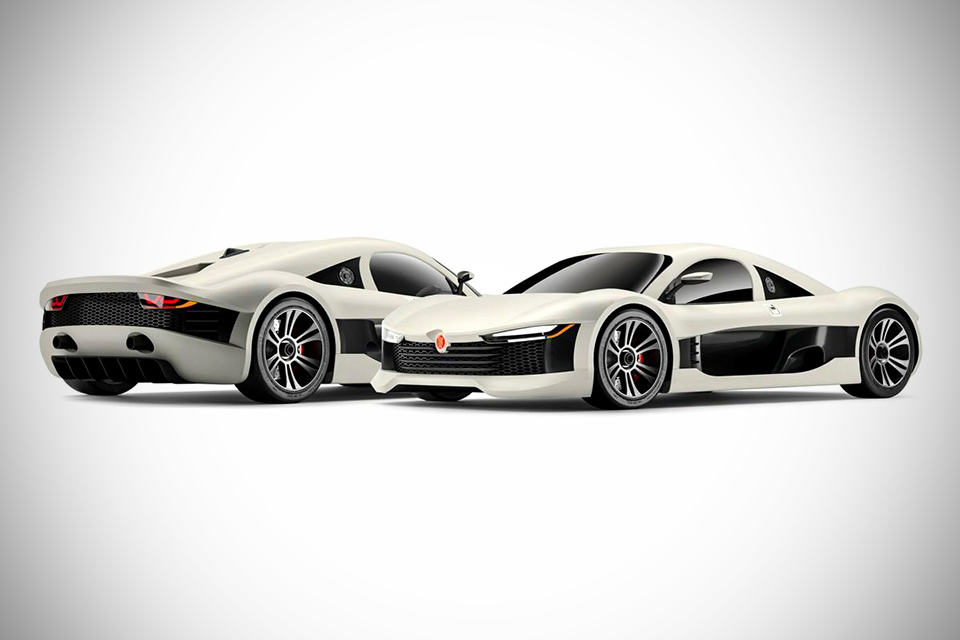

3. You Can Get a New-for-Old Vehicle Replacement

If you purchased a brand new car recently, some insurance companies offer a new-for-old replacement if your car is totaled during an accident.

In some instances, insurance companies will even go a step further and handle the registration and CTP of your replacement vehicle. If you purchased a new car within the last few years or are considering getting a new car, deciding to buy a comprehensive cover is a good way to protect your investment.

4. Protection Against Fire, Storms, Theft, Floods, and More

Another huge benefit to owning comprehensive cover on your vehicle is that it provides coverage against damage caused by something other than a road accident.

With comprehensive cover, you are protected against the cost of damage to your vehicle due to fire, vandalism, flood, storms, riots, and theft – but that’s not all.

Comprehensive insurance will also cover damage caused by “acts of God,” such as earthquakes and meteors, as well as damage caused by animals like rodents or if you accidentally collide with a deer.

5. Extra Benefits

Aside from protecting your vehicle against damage and loss caused by accidents, “acts of God,” or theft, comprehensive insurance provides a host of extra benefits.

Some insurers provide guarantees for authorized repairs and will cover the cost of towing, lost keys, and theft or damage to the belongings and valuables that you keep in your car.

The bottom line is that comprehensive insurance covers all the things that you might not have considered because it is designed to protect you and give you peace of mind if something goes wrong.